Schrödinger's (0DTE) Perpetual

Ostium is the only place — on- or off-chain — to support consistent high leverage on stocks at scale. How?

The simple answer is by introducing what we believe has been the missing primitive for high-leverage equity trading: 0DTE perpetuals.

While the name may sound oxymoronic, it is the only appropriate description of an instrument that can be both perpetual (positions kept open indefinitely, absent liquidation), and bounded by time-based expiry at end of day (countdown timer that auto-closes positions at market close), depending on trade conditions. 0DTE perps are the Schrödinger’s cat of financial instruments, both perpetual and expiring.

No Good Options

Before diving into perps, some context on options.

Short-dated options are the most popular leveraged trading instrument on stocks and indices in the US (and India) today. Among short-dated options (≤5 days to expiry), 0DTEs are the fastest-growing segment. They already account for the majority of option volume on the S&P 500 and are quickly gaining traction on volatile large-cap stocks such as NVDA and TSLA.

They’re very cheap — a few cents to $1 per contract — and depending on the strategy, typically enable 10-20x leverage (more than half of 0DTE volumes), with up to 100x+ on deep OTM calls/puts (<5% of 0DTE volume). Beyond that, 0DTEs also eliminate overnight gap risk (more on that later), given they expire at the end of the trading day.

Importantly, options are really the only way to get any sort of asymmetric outcome on stocks in places like India and the US. There are no single-name stock futures and single-stock ETFs are extremely limited and cap out at 2:1 leverage.

And while the non-linearity of options is what gives them their appealing convexity, it is also the source of their greatest limitations. Costs and projected outcomes are complex to model. A trader can be directionally correct yet still lose money: either because the option expired out of the money, or because they misjudged factors like time decay or implied volatility.

Given the Option… Pick Perps

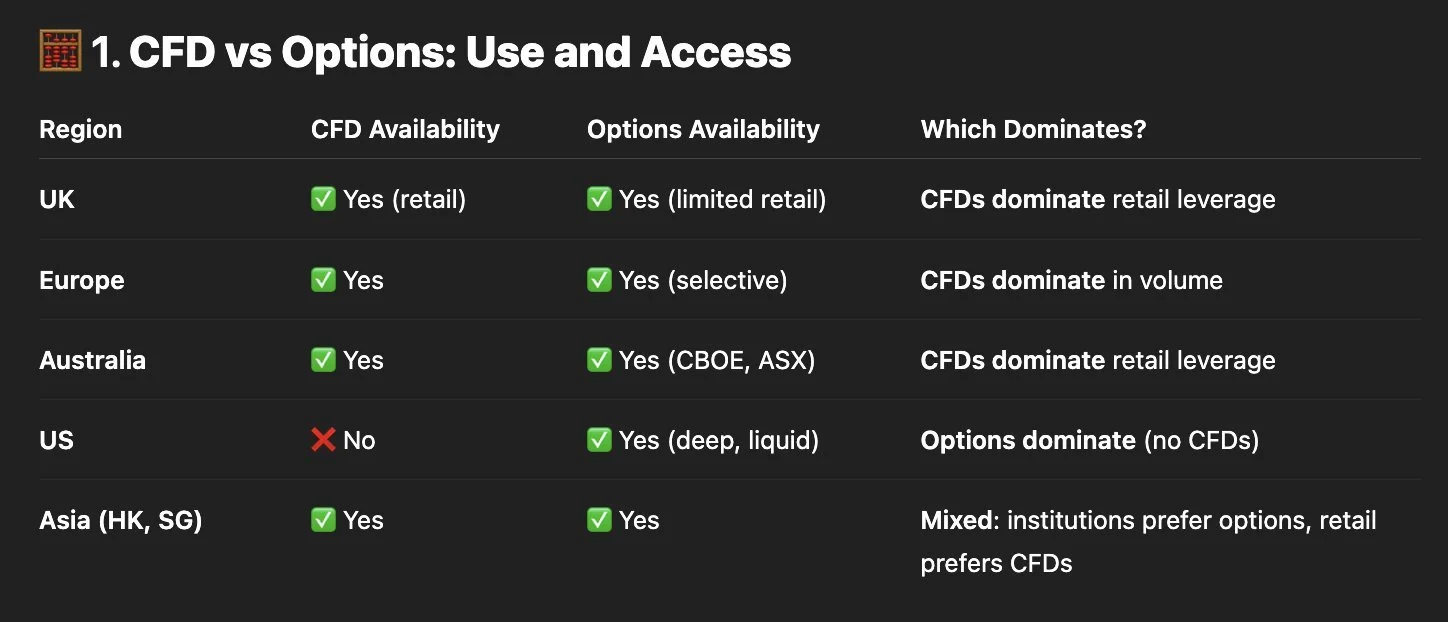

Outside the US, contracts for difference (CFDs) are the most widely used leveraged trading instruments, not just for equities and indices, but across asset classes. This market is dominated by players like eToro, Plus500, IG and others.

CFDs and perps actually share many characteristics: they’re easy to long/short, are cash settled, never expire, have linear payoffs, and usually enable copious leverage. While they also differ along important dimensions — “pure” perps have natural price discovery with a mark price that deviates from the spot index price and a funding rate designed to converge those prices, whereas CFDs are better thought of as synthetic levered spot with holding and spread costs that are a small, platform-specific premium atop the underlying market — they fundamentally service similar retail demand.

For the sake of convenience, I’m going to use “perps” as a catch-all term to refer to the sort of leveraged trading instrument that fulfills the core tenets of non-expiry, linearity, and leverage.

Crypto’s market structure is an excellent illustration of revealed trader preference when leverage isn’t the constraining factor. Perpetuals overwhelmingly dominate the crypto derivatives market, with approximately $70T/year in perps volume and only ~$1.1T in options volume per year. Perps are simply easier to understand: they trade continuously, have linear payoffs, and have no rolls or greeks to manage. Given the option between perps and options… traders pick perps.

In fact, the same is true of traditional markets in jurisdictions where traders have access to both CFDs and options. In markets where both are accessible, CFDs dominate retail activity:

As a general rule, people prefer instruments that don’t expire and have linear payouts. They want to make directional bets. They don’t want to think about greeks.

So Why Doesn’t eToro Have 100x on TSLA?

Your first question is probably what’s wrong with CFDs. They seem to work! That’s actually a much longer post for another time, but here is a quick summary in response to one of @skyquake_1‘s posts last year (and yes, “platform” is a better word — they aren’t “exchanges” as I incorrectly characterize them here, but rather quote-based trading venues).

Beyond being centralized, custodial, black boxes, and having a history (in many cases) of closing accounts after consistent winning streaks, the reality is that they don’t actually offer particularly high leverage on stocks.

Why? Overnight risk. Earnings, court rulings, and major announcements all happen after hours. Allowing high leverage overnight means likely getting blown up by a gap move. Savvy traders can easily open up delta-neutral positions on different accounts before earnings, and wind up with one side liquidated and the other in large profit. Most platforms face restrictions around negative account balances; the liquidated side doesn’t make up for the profitable side and the platform takes a hit.

To summarize the state of affairs:

Traders want: linear payouts and instruments that don’t expire → perps & perp-like instruments (CFDs)

But, traders also want: leverage (if they can’t access the above) + to avoid gap risk → 0DTE options

Problem: no instrument offers the holy tetrad of linear payouts, leverage, low gap risk, and non-expiry

Introducing 0DTE Perps: Separating Intraday From Overnight

We started with one core insight: intraday and overnight trading are fundamentally different regimes that require different rules.

During market hours, stocks have high liquidity, continuous price discovery, and manageable risk. A responsive liquidation engine can manage aggressive leverage. Overnight, stocks experience gaps, surprises, and thin liquidity. Dangerous for high leverage positions.

Thus, 0DTE perpetuals. They enforce separation between these two regimes:

Market open: up to 100x leverage when risk is manageable

15 minutes before close: positions above 10x auto-close; everything else rolls to next day

Clean, predictable structure that aligns leverage with actual market conditions

Traders with open “Day Trading” (>10x leverage) positions see a countdown timer on the interface, labeling the time until their positions expire. The beautiful thing is that a single position is modular and can be both expiring and non-expiring, just never at the same time: traders can easily top up highly levered trades to keep them open overnight. Unlike 0DTE options – which necessarily expire at end of day and require manual close and reopen of a new position with a later expiry if a trader wants to maintain exposure to an asset – 0DTE perps can in theory stay open indefinitely if a trader manages leverage appropriately.

How To Have Your Perp and Expire It Too

0DTE perps combine the best of 0DTE options (leverage, gap risk control) with the simplicity and linearity of perps.

Unified Instrument: One position acts like a 0DTE or a perp, depending on how a trader manages it, without needing to be closed and reopened

Predictable Payouts: No greeks to keep track of, linear payout structure of perps

Leverage, But Limited Gap Risk: Intraday leverage up to 100x, auto-reduced before close to prevent overnight blowups

Liquidity concentration: One instrument per asset, no fragmentation across strikes or expiries = deeper liquidity

Summarized in visual form:

We built onchain 0DTE perps to compete directly with the most liquid leveraged trading instruments in traditional markets. They not only benefit from the transparency, accessibility, and credible neutrality of onchain trading, but are also a structurally better primitive.

TL;DR

Traders prefer linear payouts — they don't want to think about greeks! — and instruments that don’t expire

Thus, when given the choice between perp-like instruments and options… they pick the former

Short-dated and 0DTE options dominate in markets or geographies with no alternative: single-name stocks, US/India

Even linear-payout CFDs don’t offer much leverage on stocks because of gap risk

0DTE perps combine the best of both worlds and satisfy the holy tetrad of trader preference: linear payouts, high leverage, low gap risk, and non-expiry

Originally published on X. July 2025.