Splitting Settlement from Market Making

Setting the Scene

The current single vault model has delivered ~$10B volume, $4M in fees, and 25 novel RWA markets without formal market makers

However, combining settlement + imbalance/flow exposure into one pool creates unpredictable LP returns and caps capital efficiency

Ostium will evolve to support a dual vault architecture that separates out passive (settlement) from active (hedging) liquidity

Goal = deliver higher capital efficiency for traders, better yield predictability for LPs, and improve protocol monetization

Since launch, Ostium has relied on a single USDC vault to support every trade. This model has served the protocol well, powering nearly $10B in cumulative volume and access to TradFi markets like Copper, FTSE, and Nikkei for the first time onchain. But the architecture carries structural inefficiencies that limit capital scalability and LP performance as the system grows.

This post outlines how we're evolving Ostium's liquidity model, first by introducing delta-neutral hedging across select markets, and later by building this function out into a second, dedicated vault that executes on these strategies programmatically (and which users will have the option to participate in). Ultimately, Ostium's liquidity model will evolve to split settlement from flow management. The goal is to preserve what works and improve what doesn’t by taking as inspiration the common principles shared by the most successful platforms across TradFi and crypto (Robinhood, eToro, Hyperliquid).

The Current System

Ostium’s current vault performs two roles:

Settlement: To support atomic, instant execution onchain, there must be capital available at all times. Unlike centralized venues (e.g., Webull, eToro) that net positions and delay withdrawals for 2–3 days, decentralized systems must provision capital upfront to settle every trade, even in a fully delta-neutral environment.

Directional Exposure: When trader flows skew long or short, the vault effectively takes the other side. A $20M net long in Gold, for example, results in $20M of net short exposure for the vault and its LPs.

These two roles have very different capital requirements and risk characteristics. Yet under Ostium’s initial design, both are handled by a single capital pool. That coupling worked for bootstrapping liquidity but introduces inefficiencies that are increasingly costly.

Structural Tradeoffs

Without a single formal market maker, Ostium’s architecture has enabled:

Nearly $10B in cumulative volume

9,200+ unique users

165,000+ trades

25 RWA markets, including assets never before offered at perp scale onchain

$4M+ in protocol fees

It mirrors elements of GMX v1 and Jupiter’s models, which similarly leverage oracle-based vaults. But as we scale, two core limitations have become clear:

1. Limited Capital Efficiency

Because the vault takes on directional exposure, Open Interest must be scaled conservatively to avoid outsized trader wins that would impair LP capital. These constraints directly limit available liquidity and position sizing for traders.

2. Path-Dependent LP Returns

The OLP has seen APYs fluctuate between +50% and -5%, primarily driven by directional trader flows. This volatility makes returns unpredictable and discourages stable capital commitments from LPs.

The Solution: Evolution in Two Phases

Phase 1: Dynamic Delta Hedging

We’re rolling out infrastructure to reduce the vault’s directional exposure through a dedicated external entity: a sister fund that operates independently from Ostium. This entity is designed specifically to hedge open interest imbalances in the underlying markets that arise from user positioning on the protocol.

The offsetting leg of hedging positions is performed externally and off-protocol. The fund operates using independent infrastructure & capital, with a mandate to dynamically hedge directional exposures on Ostium, with corresponding off-setting positions in the underlying market.

This approach allows Ostium to neutralize sustained directional risk for LPs without reliance on unaffiliated third-party market makers. Over the past month, this hedging setup has been piloted across select markets — and has already led to a meaningful reduction in LP return volatility.

To fund hedging activity, we are updating fee flows:

The percentage of opening fees allocated to LPs will shift from 50% → 30%

LPs will still accrue over 50% of total protocol fees across opening, rollover, and liquidation fees

New fee distribution with Phase 1 hedging infrastructure in place.

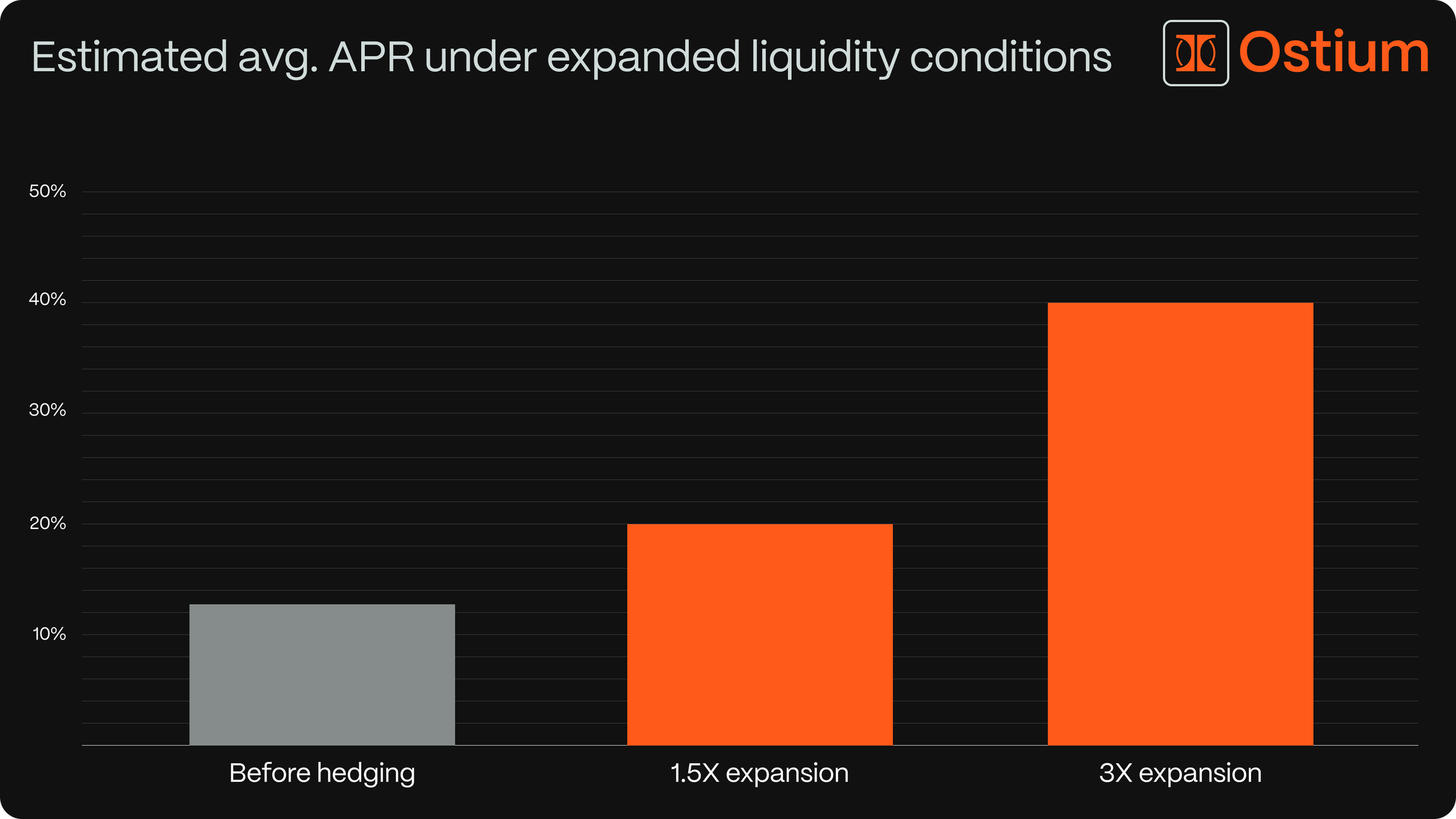

We expect these changes to result in substantial Quality of Life improvements for Ostium’s LPs and traders:

Improved Sharpe ratio and return variance on OLP

Higher OI capacity relative to vault size

For comparison, while the greatest single-day down-shock to OLP over the last 30 days was -27bps, the greatest single-day down-shock in the 60 days prior to that (before hedging began) was -61bps. (Source: Dune).

More information on the hedging entity and its planned evolution will be shared in an upcoming post.

Phase 2: Dual Vault Architecture

The next step is architectural. Ostium will be launching a second vault in the coming months to support the liquidity model’s evolution towards programmatic separation of the two core functions of LP capital in any asynchronous or external price-based system: settlement and directional imbalance management.

OLP (Settlement Vault): Handles atomic execution and trade settlement. Under the new system, OLP will evolve towards becoming a lower-risk, delta-neutral settlement layer for trades on Ostium, protected from any large or sustained net exposures through the dynamic hedging activity of the second vault.

OMM (New Market Making Vault): Assumes and dynamically hedges flow in the underlying markets. This new vault, rolled out as part of the transition to Phase 2, will operate what readers should anticipate to be a higher-risk, higher-variance strategy (NFA), hedging accrued directional exposures in the underlying markets and dynamically rebalancing into the onchain vault.

A sustainable liquidity model for asynchronous systems like Ostium’s will need to ultimately grow to separate out its two core functions — settlement and imbalance management — because of how different the risks and commensurate expected return profiles are on these two functions. Fully collateralized settlement should generally be thought of as meriting low and stable returns, while dynamic hedging is higher-risk/return and higher variance.

Why It Matters

We believe that in an end state, the two primary sources of revenue for any exchange/trading platform should be split:

All revenues from flow should, at a minimum, enable full support of the liquidity model.

All revenues from fees should be programmatically routed to support the network.

Readers should recognize many similarities to existing platform models, validated across web2 and web3 by Fintech and DeFi applications:

Robinhood began effectively as a data business, monetizing user flow, enabling it to eliminate spot trading fees and reinvest revenues across the platform

eToro, Plus500 & other CFDs operate internal A/B books to monetize directional flow

Hyperliquid uses its HLP system to convert flow into subsidized liquidity while routing fees into protocol-level buybacks

We are fans of this model, and believe it to be the most sustainable means of long-term monetization. This remains true whether flow is monetized through order routing (Robinhood), internal MM (Hyperliquid), or direct counterparty trading (CFDs).

Addressing Common Questions

1. Why not build an orderbook?

Traditional markets like EUR/USD have $300M+ in top-of-book liquidity. Tokenized versions often have 10,000x less liquidity, making reference prices highly manipulable. An onchain orderbook would either need to reference these thin tokenized assets or accept massive gap risk during market closures from the perp's own limited liquidity.

Safe leverage then drops from 100x to something like 3x, and safe OI caps out at a fraction of the tokenized market rather than a fraction of the underlying market. Oracle-based systems allow you leverage the underlying market's deep liquidity by quoting its spreads and letting the vault system hedge out risk on the back end.

You can also read more about our architecture choice here, here, and here.

2. Why not rely on funding rates to balance OI?

Even crypto, with billions in dedicated funding rate arbitrage capital and infrastructure like Ethena’s purpose-built for capturing the upside on these rate differentials, still sees persistent funding rate imbalances after nearly a decade. For RWA perps that infrastructure simply doesn't exist.

We tried this in Ostium's initial design. We found that funding rates on traditional assets wound up just killing demand in the “popular” direction without creating sufficient counter-demand in the “unpopular” direction. We wound up with worse liquidity, not balance. Users tolerate high funding rates in crypto because of its volatility; they don't for traditional assets and just wind up going elsewhere.

It's worth pointing out that even if funding rates did have an impact on imbalances, that impact would be insufficient to fully neutralize the large directional exposures that come from an inelastic market. It's very hard to convince people to short gold when it's ripping.

3. Why not use asset-specific pools like GMX V2?

Asset-specific pools fragment liquidity exactly where we need it most—for long-tail TradFi assets with no other onchain market. Capital would get trapped in isolated pools, and we'd lose the ability to net opposing directional imbalances (long Gold, short Silver couldn't offset each other).

We believe the better approach is splitting settlement from directional exposure management. Different functions need different pools serving different risk profiles, not artificial asset boundaries that kill capital efficiency.

TL;DR

Ostium is transitioning:

From

A single vault bearing both settlement and directional exposure

No hedging infrastructure

Unpredictable LP returns and capped capital efficiency

To

Dual vault architecture with clean separation of functions

Dynamic hedging of directional deltas

Higher capital efficiency and better yield predictability

More updates on architecture and hedging infrastructure to come.

Originally published on X. June 2025.